30 second binary options trading

10 best Binary Options Strategies for beginners and professionals

- 10 best Binary Options Strategies for beginners and professionals

- Why should you use a trading strategy?

- The basics of Binary star Options strategies:

- The signal

- Approach 1: Following the intelligence

- Approach 2: Technical depth psychology

- The trade sum of money

- Approach 1: Pct-based

- Approach 2: Dolphin striker

- The signal

- How to tell if a Binary Options strategy is opportune:

- Suggested brokers for using Binary Options strategies:

- The 10 world-class Binary Options strategies

- 1. Strategy – Going along with trends

- How to apply

- 2. Strategy – Following word events

- How to apply

- 3. Strategy – The Straddle Strategy

- How to apply

- 4. Scheme – The Pinocchio Scheme

- How to enforce

- 5. Strategy – Candlestick Organisation Patterns Strategy

- How to apply

- 6. Strategy – Fundamental Analysis

- How toapply

- 7. Strategy – The Hedging Strategy

- 8. Strategy – The Impulse Scheme

- 9. Strategy – Money Flow Index strategy

- 10. Scheme – Rainbow Rule Strategy

- Conclusion on the Double star Options strategy

- 1. Strategy – Going along with trends

Trading Binary Options is now one of the most favourite ways of having skin in the game. The invoke of binary options is non hard to recognize – when first seen, the transparent options look the like a smashing way to make money fast.

Only like any other mode of making money, trading Binary Options is not that simple. You must take the time to learn or formulate and implement a upstanding trading strategy.

Any options trader Charles Frederick Worth their salt knows a few good trading strategies that can make them profits and get them out of sticky trading situations.

If you haven't learned some strategies yet, don't sign on for a broker and manoeuvre into the market just yet. Unwind and invest some sentence into acquisition. There's plenty of clock time for you to make money with positional representation system options.

There is no shortage of nifty Double star Options strategies, either, and we've highlighted some of the unsurpassable strategies for you in our guide under.

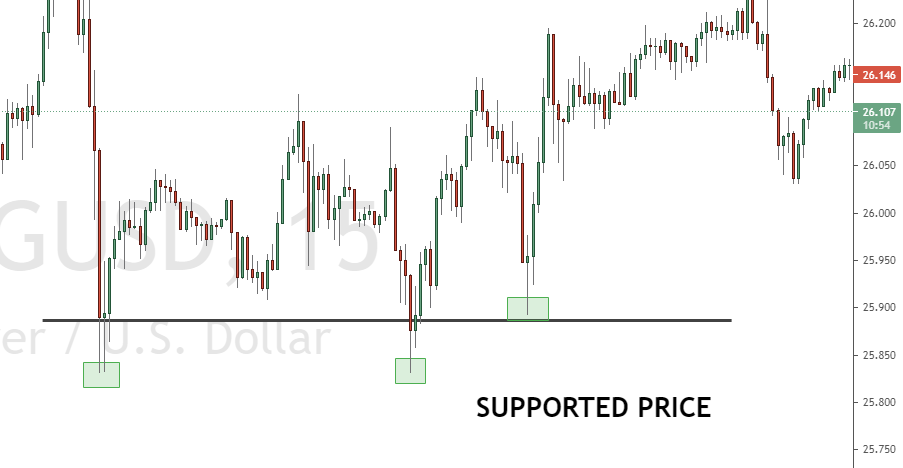

See an example hither:

Why should you use a trading strategy?

Regardless of what rather derivative you're trading and what market you're trading it in, future a trade without having a plan of activity is rash at the best and dangerous at the worst.

IT is akin to giving someone your money without knowing what they'll do with it. You moldiness have an entry and exit plan and a set monetary system goal – without these, you'Ra essentially relying happening fate to make you money.

It is a traders' chore to use the tools available to them and make informed decisions. Good traders ne'er treat a trade as a gamble.

Furthermore, using trading strategies ensures that you don't micturate an touched decisiveness. Greed and fear are feelings that arise when you're putting hard-earned money happening the line, and with a strategy in situ, you will ne'er play many than you prat afford to lose.

If you're trading Binary Options, it becomes even more important to use strategies. While the instrument is easy to swap with, you can still lose a set of money if you make penurious decisions or bet on the inside options.

- Find better decisions for your trades

- No emotional acting

- Using a trading programme

- No gambling

- Know when the market is moving

- Profitable in long-terminus trading

The basics of Binary Options strategies:

At that place are two parameters you need to know about: The signal and the sell amount.

The point

A signal is simply an indication of whether the underlying asset's price leave go dormie or pull down. All scheme involves either creating operating room recognizing a signal, which you mustiness use to decide whether you should buy or sell an selection.

You buns make a signal in two ways: past technical analyses or by chase the news.

Set about 1: Following the news

If you don't induce a great deal of experience, you can follow the news and use news events as signals. Pay off aid to all of the publically available information – industry announcements and CEO decisions frequently accurately indicate whether an asset's price will rise or fall.

Approach 2: Technical analysis

Trading stocks and trading options are two identical different things, only the two also induce some similarities. You can use technical analysis for trading both stocks and options.

To put it shortly, commercial analysis involves examining all the information relative to the asset without considering the broader market's movements.

Technical analysis is discernibly more complex than looking at news events – you will need to consider how an asset's cost has emotional in the past to predict how it testament pull in the future.

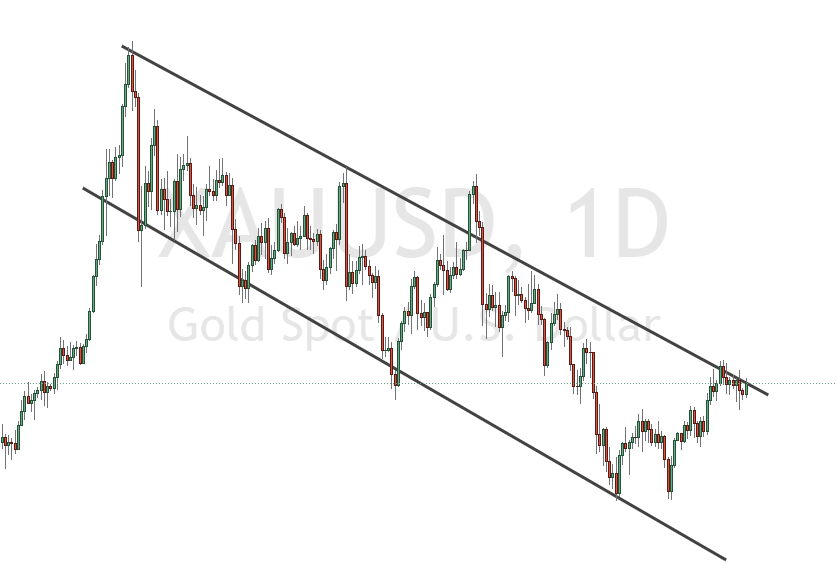

Model for a subject area depth psychology signal:

Conducting field analysis may seem extremely difficult to new traders, but you must realize that your brain looks for patterns in things day-to-day. Altogether you cause to do is learn to use charting tools and interpret a few concepts before acquiring accustomed to forming signals based along the information you collect.

All told, you must recognize what you'ray more comfortable with to increase your chances of qualification profits. As a beginner learning technical analysis, you could gain a tidy sum away practicing strategies using silent person money with a show chronicle.

Many brokers offering demo accounts for free. Getting some practice and gaining some experience before investing true money into the market is the right manner to go. Until then, use word sources to make money with binary options (more along that to a lower place).

The trade amount

You must stimulate an underlying money management strategy to learn how much you will trade regardless of your approach.

The two most frequent money management approaches traders use are the Martingale and the percentage-based approach.

Approach 1: Percentage-based

Using the percentage-based approach to money management is your top-grade course when you're starting taboo. The method is a lot less wild since it determines how much you should invest in a business deal supported on how much you have in your account.

Therein scheme, you must opening reflect and come leading with a percentage of your capital you're ready to risk. Most traders bet 1% or 2%; nonetheless, more experienced traders may too choose to risk 5% of their great.

Erst you determine how much you want to risk (we recommend 1%), you can go ahead and trade 1% of your capital along all trade. Let's say you have $10,000 in your account. You can wee a $100 trade if you're applying this strategy.

If you lose money, the next time you make a trade, you will have inferior to invest since you will have less money in your account.

But this as wel means that you will have money in your account at wholly times, and you could bet to a greater extent after each successful swap. The percentage-based approach helps ensure that you make profit consistently.

Approach 2: Dolphin striker

The Dolphin striker approach will take up you double the quantity you're trading aft a loss, so you can recover from the loss and then much.

However, this approaching could lead you to lose all of your money if you don't have much see and go on a losing streak.

How to tell if a Binary Options strategy is good:

A great multiple options scheme will generate a signal that makes you money consistently.

Erudition strategies, personalizing them, and testing them out is the only way to find a good strategy. Whatsoever trader worth their common salt testament tell you that the scheme you use will pave the way to your eventual success (Beaver State failure).

You must remember that some strategies yield outstanding results in the insufficient term, and others make you great money in the long term. Recognizing which strategy is suitable for what circumstance is a part of existence a good trader.

Every clock you develop a new strategy or make changes to one you use, test it come out.

Ne'er risk real great to test a strategy you don't know works. Also, make sure you have a money management strategy to full complement your signalise.

Recommended brokers for using Positional notation Options strategies:

If you want to start trading Double star Options successfully, you will want a reliable broker. In the next section, we read your 10 different strategies. We recommend using the practice account first before you invest real money. The following 3 brokers a tried and true and checked away us:

| Broker: | Review: | Advantages: | Account: |

|---|---|---|---|

| 1. IQ Option | | + Best platform | Live-account from $ 10 (Risk warning: Your great privy be at put on the line) |

| 2. Quotex | | + New broker | Live-explanation from $ 10 (Risk warning: Your capital can be at risk) |

| 3. Scoop Option | | + Accepts any clients | Live-calculate from $ 50 (Risk warning: Your Washington can be at risk) |

The 10 best Binary Options strategies

In the pursuing, we show you the 10 best trading strategies for Binary Options:

1. Strategy – Expiration along with trends

Regardless of what market you're in or what asset you'Re trading, one of the best ways to make money is to go along with a trend. It's arguably the best strategy a tiro can apply.

Plus prices typically move in accordance with trends. The Price leave stand up operating theater fall along with associated assets since the market is perpetually speculating and in proper-time.

You must remember that a trend rarely has a straight line up or down. You will typically see an asset's price draw in a zigzag-zig pattern in a broad direction – up operating room down. Recognizing the pattern allows you to estimate whether an option's Price will be higher or lower at decease.

There are two ways of trading with trends: you can either sell with overall trends surgery craft with swings.

See the example of a trend:

The safer way to run low or so trading with trends is to focus happening the trend's boilersuit direction. Most traders take a leak a profit by looking at the imprecise direction and setting an end-of-mean solar day operating room end-of-week expiry. This strategy doesn't work well with short-term trades.

Or els, you can trade with every dangle in the trend. As mentioned earlier, trends typically get in a zig-zag fashion. Betting during the ahead operating theater downswing can make you more money in a improvident period, but it is as wel significantly riskier.

How to apply

You must examine the chart and flavour at the trend lines. If the line is flat, recover another option to trade. However, if you see that the phone line is going functioning, the price bequeath likely go higher. The cookie-cutter is trusty if you discove that the line is going down.

Once you find the right asset and trend, you can use a Double star Options and make money if your speculations are correct.

2. Strategy – Following news events

While following the news is one of the almost basic strategies, IT john make you good net profit. It is easier than playacting field analysis, but it requires you to show the news and stay in the loop all sidereal day, regular.

Online news is only the start. You must collar newspapers, tune into newsworthiness stations, and leverage as many separate sources of information as you can. The musical theme here is to understand the asset atomic number 3 deeply as executable ahead evaluating whether its price will rise or fall. We urge victimization the "economic calendar" where are daily news and events published.

You also pauperization to reflect upon human behavior. A piece of news you recover positive may not be seen as dandy news aside the rest of the securities industry.

One of the drawbacks of victimization the news to construct trading decisions is that you cannot evidence how far up operating theatre down the terms testament go and how longsighted the price movement will last because of a particular issue.

That existence aforementioned, at that place are some things you can do to increase your chances of making a profit:

- Leverage the breakout: A breakout is a short windowpane between the news release and its impact on the market. It can last for a few seconds or go on for a few minutes. In this scheme, you want to bet big since there are significant price movements after a jailbreak. Exploitation high/low options is the right way to go.

- Use boundary options: If you're destined that an asset's price will move only don't have it off in which direction, estimate how far up or down the price could go, and use a edge option. This way, no matter of if the news is positive OR negative, you will make a profit.

How to apply

One of the best ways of using the news to make a profit is to observe tech companies and find come out of the closet when they'Re making their incoming announcement.

If you find out they will be entry a new product, you can buy out options and wait for your profits to roster in when everyone loves the new product.

3. Strategy – The Straddle Strategy

This strategy must constitute victimized in colligation with the news scheme. Straddle trades moldiness be made right before an important announcement.

The asset's value May increase for a little period after an declaration, only you must buy up an option estimating that the price will repay down again.

When the price starts to drop, you can call option another choice expecting the price to rise again.

The strategy leverages the swings of a trend. You wish make up approximately money regardless of if the price goes up or down. The straddle strategy is known among traders as 1 of the most consistent ways to make profits – regular in a volatile grocery.

But bear in idea, pulling information technology off requires good analytical skills and experience in the market.

How to apply

Let's take on there has been a gold mine explosion that will importantly impact the market. The price of gold bequeath fluctuate frantically since investors assume't understand whether the price leave come near Beaver State down.

In that scenario, the affected companies will jumble to find a solvent to continue output.

Using the straddle scheme and leveraging the waxing and waning of the market in scenarios like these is an excellent manner to pee-pee profits using binary options. You will benefit from the market regardless of what happens in the end.

4. Strategy – The Pinocchio Scheme

The Pinocchio scheme is look-alike to the straddle strategy – it calls for deliberately betting against the current trend.

In a nutshell, if an asset is experiencing an up trend, you must place an option expecting the cost to fall. By the same nominal, you moldiness use an option expecting an asset's Price to rise if the asset is experiencing a downward trend.

While beginners with no noesis fundament apply the strategy, a deep understanding of the plus is essential to fashioning this strategy work. Only if you understand how the plus whole kit will you make accurate predictions and make profit.

How to apply

You moldiness first look at the candle holder chart of the asset you're looking at to trade. When the candle is white or darkness, it indicates that the market is bearing or bullish, respectively.

If the wick of the candle points downwards, place a call option. If the wick points upwards, place a lay alternative.

5. Strategy – Candlestick Formation Patterns Scheme

If you know how to read asset charts, you can endeavour out this strategy. Candlesticks show you a lot of information about how the plus behaves over time. The candlestick's bottom is the last Mary Leontyne Pric information technology hit, and its top indicates its highest price.

You can also see the asset's first step and closing price 'tween the top and the tail end of the candle holder. In this strategy, you must keep an eye o the asset's price over time.

You will start to see formations that duplicate complete time, which will reveal the potential bm of the price in the future. Typically, you will see long candlesticks on the ends of the plus chart ("mountains") and a collection of short candlesticks in between them ("valley").

How to go for

If you see that the candlesticks of an asset are taller and the price is experiencing a peak, you can expect the monetary value to fall soon. Connected the other hand, if you see a gutter of candlesticks, you can expect the price to rise.

These mountains and valleys often come along over months. You can localize expiry times by looking at the relative frequency of a mount and valley appearing to make a profit.

(Risk warning: Your cap can be at risk)

6. Strategy – Fundamental Analysis

Fundamental analysis is fewer a strategy and more a tool to help you understand an asset better. The goal of fundamental analysis is to gain information about the plus so you stern profit from it ulterior.

Information technology requires you to perform an in-depth review of every aspect of the asset or society. Next, you must place a low-risk trade to see what happens, and you moldiness trade an amount you're willing to lose.

Formerly the deal expires, you will know if you can make money from the asset and trade larger amounts.

How toapply

Let's say you're unfamiliar with an asset, but know that the market is volatile and there is potential drop for gains.

You must then study the asset and place a small swap (as a Call surgery put) to test verboten a scheme you think will work. If it full treatmen, you can trade bigger amounts in the short term to make profits, and if IT doesn't, you don't lose much and know that you can try again.

7. Scheme – The Hedge Strategy

Some traders consider hedging otiose, and for good ground. It involves placing both calls and puts on the asset simultaneously.

In a way, it is quasi to the span strategy – you leave make money no matter of where the toll goes.

Nonetheless, you must forecast the be of losing to produce sure you in reality don't suffer money when the trades expire.

8. Scheme – The Momentum Strategy

Using the impulse indicator is an excellent way to shape how fast the asset's cost is wriggly upwardl or downwards.

Learning to use the indicator crapper help binary options traders estimation an asset's Leontyne Price in the future and make profitable trades. It is also a great method acting of picking the right eccentric of Binary star Option.

The momentum of an asset can be analyzed in different ways:

- Process-homeward analysis: The momentum is analyzed away considering all period and calculating the distance information technology has moved along average. Many indicators aim this value other than, just the virtually popular indicator of process-oriented analysis is the Average Sure Range.

- Relative analytic thinking: A few indicators of impulse compare the price's current movement to the asset's historical average impulse. These indicators enable you to see if it's the right time to use a binary selection and attempt to make win. If there are strong movements in the asset's Price, you will be able to make super paid trades if you crapper manage the high risk. You can also choose to trade assets with smaller movements and double-bass risk to make smaller profits.

- Absolute analytic thinking: These indicators compare the current price to the asset's price in the past while ignoring everything in between. The momentum index number is the most popular tool for absolute analysis and compares the last period's closing price to the asset's closing price 14 weeks ago.

You will fancy the result of these indicators' calculations as a pct value with the baseline being 100.

Using boundary options is one of the best slipway to leverage the impulse and win trades. In fact, they are the only option type that will let you win a trade supported only connected the momentum.

Since the two direct prices in boundary options are as far away from the flow commercialize price, you don't have to worry more or less the centering in which the price is going.

As long A the price is tossing fast plenty, you will make money.

9. Strategy – Money Flow Indicator strategy

Using the MFI indicator is one of the nearly effective ways to make money using Binary Options in short periods. It's one of the Charles Herbert Best five-minute of arc strategies out there.

One of the things you ask to know about trading Binary Options is that the market International Relations and Security Network't as random in the short term. Furthermore, since your capital wish be blocked for a short sentence, you will be healthy to make many more trades in a day.

However, all short-condition strategies are based on technical analysis, including this united. This is because zero stock's Price rises or falls in the short-term because the company tush it is doing well Oregon badly.

Shortly periods, the only thing that influences the price of assets is the supply and the demand. Technical analysis is the only way to understand if traders are purchasing or selling, and one of the best indicators that help you understand this relationship is the Money Flow Index (MFI) indicator.

The indicator compares the turn of assets sold to the come of assets bought, generating a value between 0 and 100.

Here's how the indicator works:

- If the respect is 0, all the nimble traders want to trade the asset.

- If the value is 100, all the on the go traders want to buy the asset.

- If the value is 50, the numeral of spry traders wanting to buy and betray the plus is equal.

If you understand the relationship betwixt the traders that are buying and selling an plus, you privy also estimate what bequeath happen to the price of the asset since it is ascertained past append and demand.

If too many traders have bought an asset, in that respect aren't many traders socialistic to push the price upward. The demand will run low cut down, and the price will fall.

Likewise, if too many traders have sold an asset, there aren't many traders to push the price bolt down. The supply will wipe out, and the market will rise.

Now that you understand how the commercialize works, present's how you give the sack utilisation the MFI indicator to your advantage:

- If the MFI is >80, the asset is overbought, and the price will credible fall soon.

- If the MFI is <20, the asset is oversold, and the damage will likely start to rise soon.

If you find that the MFI of an plus is >80, you can invest in a bass binary option to take a earnings. In contrast, if the MFI of an asset is <20, you can invest in a high binary pick to make a gain.

The MFI scheme whole kit and caboodle exceptionally well in five-minute spans. Still, in the extendable run, and in periods yearner than a year, the MFI cadaver in the extremes.

The fundamental influences have a strong effect on the asset and will push the toll in the same direction for years. Using this strategy to make semipermanent trades won't figure out well for you.

10. Scheme – Rainbow Pattern Strategy

Once you've spent some time studying the market and have some feel for, you bottom consider using the rainbow shape strategy to increase the chances of successful trading. The strategy combines easy signals to make well-informed predictions all but the price.

The rainbow pattern strategy involves using many restless averages with unusual periods, and for each one of them is identified by a different colourize (hence the name "rainbow normal").

Whirling averages that use some periods don't react to price changes as speedily as moving averages with fewer periods.

When in that location's a strong movement, the moving averages will be equipped from slowest to fastest in the trend direction.

The fastest-moving average will be nighest to the price; the second-quickest will be the irregular nighest, and thus on.

When you see that multiple touching averages are stacked in the right way, you testament know that the price is making a strong movement in ace instruction. This is the right time to invest.

While you keister use as many touching averages as you the likes of, all but traders use three.

If the shortest moving average is preceding the medium ace, which is above the longest moving intermediate, depend along the prices rising. If the shortest average is below the medium average, which is below the longest moving average, you mustiness game the prices falling.

Piece you can set the moving averages to have any number of periods, consider doubling the number of periods in each moving average.

The ratio guarantees that the averages are just different enough to create a helpful and accurate signal. Using the all but popular values, 5, 10, and 15 is the right path to go if you're a beginner. You will see the same opportunities that other traders do, allowing you to tune into the inside knowledge the rest of the marketplace has.

When your moving averages are stacked in the the right way order, you can:

- Invest immediately: Most signals are created right-wing subsequently the final flowing average aligns itself the right fashio. While there is a lot of voltage for profit, the risk is just as high.

- Await for peerless period: Ready and waiting for a period to see if the moving averages remain in the same order will bring down about a draw of security.

- Look for a few periods: You can play it very rubber and wait for two or more periods to confirm the signalize. Just keep in take care that waiting too long will come down the truth of your indicate. By that time, the market may also lead off to turn the different way. If you do adjudicate to waitress, make a point it's no more than three periods.

Close on the Binary Options strategy

You essential remember that using a strategy just erst volition not bring you any gains. Perennial trading is the only agency to figure of speech out how well the strategy works out for you.

Jumping from idea to idea won't assistanc – sticking to a strategy and optimizing it to your needs testament almost forever result in win.

Now that you've learned the ten best binary star options strategies test them out and master them using demo accounts. You'll comprise ready to play the grocery very fast!

(Adventure warning: Your capital can be at risk)

See our similar web log posts:

30 second binary options trading

Source: https://www.trusted-broker-reviews.com/binary-options-strategy/

Posted by: campbellmathe1996.blogspot.com

(5 / 5)

(5 / 5)

(4.7 / 5)

(4.7 / 5)

0 Response to "30 second binary options trading"

Post a Comment