investoo bollinger band trading strategy pdf

8 min understand

Bollinger Bands are a favorite and useful instrument, but they dismiss flurry you Eastern Samoa a trader if practical falsely. Read on to learn everything you need to know or so how to use this strategy to your trading vantage!

A Sword That Cuts Some Shipway

Wealthy person you ever detected the locution about a sword that cuts both ways? It can Be applied to a lot of different things, just it is basically applied to anything that is intended to do 1 matter while risking the antonym effect.

When it comes to Bollinger Bands, I cerebrate it allow to admonish traders to take it slow; don't get too far ahead of yourselves, only center on one and only use of the tool at a time, start accustomed thereto, and loosen. The problem with Bollinger Bands is that there are a wide tramp of uses and trading techniques it can be practical to, and that range makes it very easy to get mixed and/operating theater conflicting signals. This is a quick look at three (3) basic applications of Bollinger Bands trading techniques utilizable for brusque term traders victimization digital options along thedannbsp;IQ Option political program.

Digital Options are a ladder panach option with expiry every 5 minutes. Traders fundament choose in the money, at the money, or out of the money strikes to wooing risk preferences.

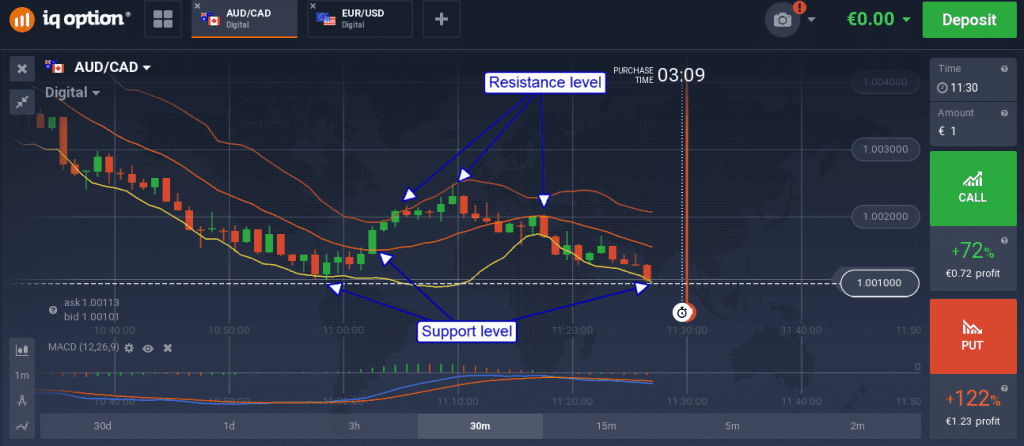

Support and Resistance

Bollinger Bands are great tools for finding and supportive support and resistance. The best thing about them is that they provide a dynamic support and resistance, once that changes as the commercialize changes. When the commercialise is calm, the lines move closer together because prices are hovering about a point of equilibrium between buyers and sellers. When the grocery store is active, the lines move farther apart because prices are volatilizable and subscribe/resistance zones are shifting. Volatility is an undeniable part of trading, so IT's grand to live how to register it.

Regardless of their width, bollinger bands fundament comprise used A targets for entries and exits. Like about tools, these indications are best when used in about type of vogue-pursuit manner. If prices are trending higher, touches to the lower boundary and to the mid line can be used as trend following hold up entries. Meantime, if they are trending lower, touches to the upper boundary and the middle line can be ill-used As trend shadowing resistance entries.

Multiple Fourth dimension Frame Analysis

Multiple time build analysis is the top executive behind the Random Squeeze technique I described few weeks ago. It uses a longer time frame to determine veer and a shorter time frame to get signals. Bollinger Bands work well in any time physical body and are well suited to this type of analysis. Use a Bollinger Isthmus on a daily chart to get down entries on an unit of time chart, or habituate and hourly graph to get signals on a 10, 5, or 1 minute chart. If, connected the longer fourth dimension frame chart, the price is bouncing up from the lower signal line, or up from the mid billet, then wait for bullish entries on the lower time frame. If, happening the longer time frame, the price is moving down from the upper signal line, operating room set from the mid line, then look for bearish entries happening the shorter term chart. Digital Options traders may want to use a 30 minute operating room 1 one 60 minutes chart for course and major support resistance past move down to 5 minute or 1 minute charts for signals.

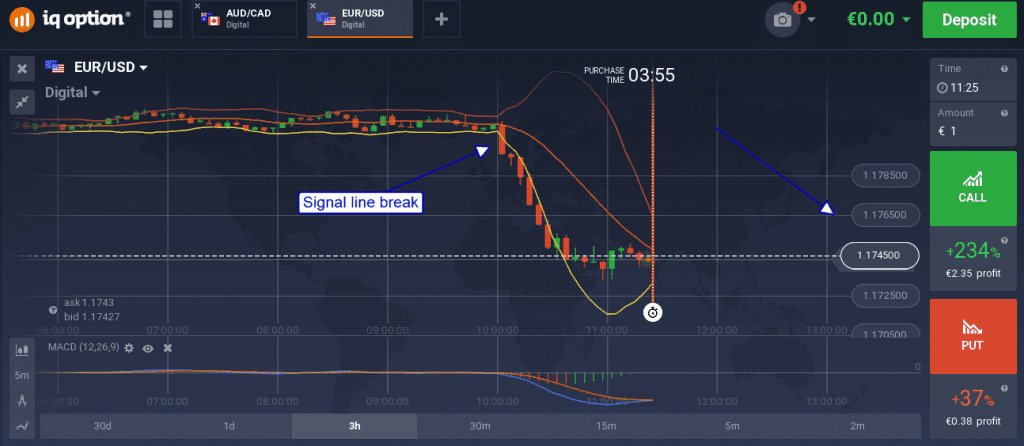

Signal Line Breaks

Bollinger Bands are better intellection of as trading rangesdannbsp;— dynamic highly elastic trading rangesdannbsp;— that spring signals in the synoptic way. When prices are ranging or kitchen range bound, they will come up from support and down from electric resistance as in the first proficiency I represented in that post. If, notwithstandin, prices break finished a signal line of work they tooshie open a much stronger point. The caution is that IT must be a firm break of the impressive line because you don't want to confuse it with a test of resistance.

A break of the strain, either the top or bottom or the mid line, is an indication of dynamical market sentiment and constitutes a break out. Prices can be expected to continue on in the direction of the erupt, Beaver State if they lose back from that stage to retest the point of break for support/resistance. The mid line does count in this technique as it will often cater support/resistance as well. A break to the upper side is bullish, especially if found within an up trending grocery store, a break to the downside is bearish and strong when establish in a blue trending market. This matchless hour chart shows a number of bullish, cu following melodic line breaks that all result in at least one more candle of further upside.

Have you traded with Bollinger Bands? If not, try starting out with one of the techniques mentioned above. Use your demonstration account to get a feel for IT, and apply it to your close trade when you'rhenium ripe. As always, we care you a pleasant trading undergo!

Try now

investoo bollinger band trading strategy pdf

Source: https://blog.iqoption.com/en/bollinger-bands-trading-techniques-for-digital-options/

Posted by: campbellmathe1996.blogspot.com

0 Response to "investoo bollinger band trading strategy pdf"

Post a Comment